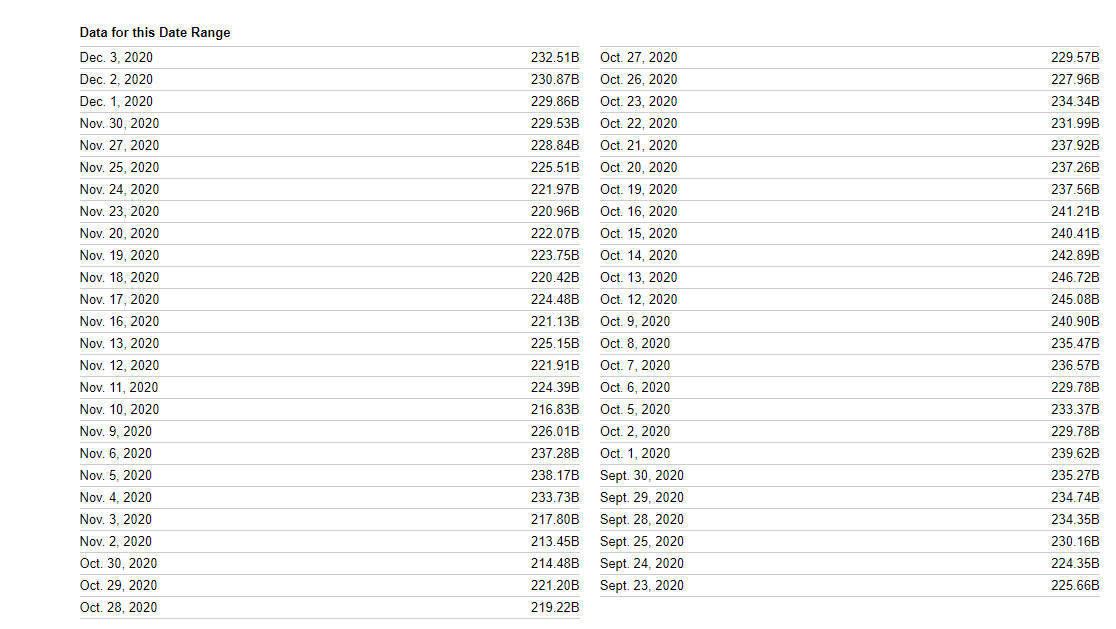

This year currently, $232.51B for Dec. 3, Adobe Market Cap 2020.

Adobe is giant into the market with largest technology equipment and benefits. Here is the day by day market capital of adobe as below:

Journey of Adobe Market Capital from 2015 to 2020 in dollars

In 2015, December, ADBE market capital was around $44.3B dollars only. But as per the market of technology improvement and global dependency on tech analysis and pdf files, adobe captured the market full handed.

Every browser and tech support is based on PDF and Adobe solution into the desktop/laptop and mobile phone devices around the globe. That’s why, adobe data was getting stronger and users data more enhanced.

Due to this reason, market capital of Adobe was growing and during 2018, capital crossed $88 Billion dollars mark. But the main flow was around 2020 after COVID-19. In this situation e-com and website based dashboards and portal had handled the World by online medium and Adobe played best profits during the season.

NASDAQ Price of Adobe

The performance is improving, that’s why, Adobe share price today is $484.28 (3rd Dec, 2020) with round 1% hike.

Key Values of the stock is as below:

| Revenue (TTM) | 12.44B |

| Revenue (Quarterly YoY Growth) | 202% |

| EPS Diluted (TTM) | 7.94 |

| Net Income (TTM) | 3.861B |

| Gross Profit Margin (Quarterly) | 86.76% |

| Profit Margin (Quarterly) | 29.61% |

Abode is preferred stock for buying when the market crashes again. Because there are no single issue in the company and stock. Currently meeting with Salesforce is booting the stock prices.

Adobe Market Cap at IPO

In its IPO, Adobe listed its total market cap as $223.42 billion for the day. This is a historic high for the company and a meaningful amount of money for Adobe in its history.

This is actually quite normal:

Amazon’s market cap is also going to be interesting to watch, as it has been growing steadily over the last couple of years. Amazon’s market cap at $1.3 trillion means that on this date in 2021, Amazon’s market cap will be more than twice as big as Apple’s: $1.4 trillion vs $845 billion.

Amazon’s market cap at $1.3 trillion means that on this date in 2021, Amazon’s market cap will be more than twice as big as Apple’s: $1.4 trillion vs $845 billion. As I mentioned above, we are also going to cover some of this in our upcoming book (that will also cover other areas of tech such as blockchain).

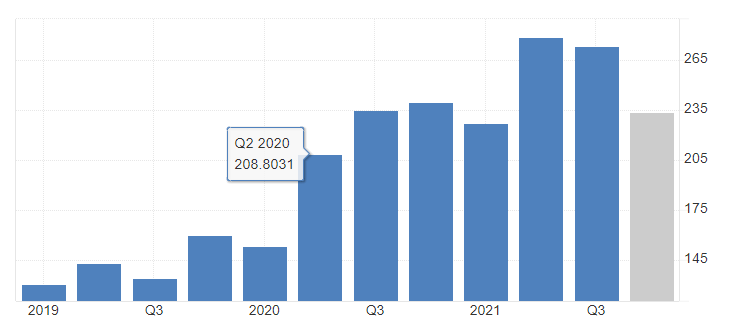

ADBE Market Capitalization Over Time

Market capitalization (or market value) is the most commonly used method of measuring the size of a publicly traded company and is calculated by multiplying the company’s stock price by its current market cap.

This is not something that can easily be calculated — but it can be inferred from other data.

We have been using this method for several months to calculate our current market value. We have made extensive use of this tool to see how we are doing in the context of our growth and where we need to focus our resources going forward. With this information, we are confident that we will have a firm idea of where we need to be going forward as well as an understanding of what our long term goals should be in terms of growth and profitability.

The main reason that ADBE Market Capitalization Over Time is useful is that it shows us in great detail where all or most of the growth has come from, with the added benefit of showing us whether or not there has been any decline in either our volume or price over time. We can thus figure out if there is anything we could do to accelerate our progress on either front, which would help keep things moving along at a more consistent pace.

We also use ADBE Market Capitalization Over Time as a way to evaluate how much money we are making from every dollar invested into our company, which helps us understand how much money we should expect to make over time.

This approach allows us to track both short-term and long-term trends as they relate to our business performance, which greatly aids both us and future investors when assessing whether or not an investment makes sense for them, even if they are not directly affected by it (e.g., if they haven’t made any direct investments).

| Year | Market cap | Change |

|---|---|---|

| 2022 | $223.87 B | -16.88% |

| 2021 | $269.35 B | 12.27% |

| 2020 | $239.91 B | 50.82% |

| 2019 | $159.08 B | 44.19% |

| 2018 | $110.32 B | 28.16% |

| 2017 | $86.08 B | 69.19% |

| 2016 | $50.88 B | 8.81% |

| 2015 | $46.76 B | 29.3% |

| 2014 | $36.16 B | 21.71% |

| 2013 | $29.71 B | 59.6% |

| 2012 | $18.61 B | 33.99% |

| 2011 | $13.89 B | -10.05% |

| 2010 | $15.44 B | -19.64% |

| 2009 | $19.22 B | 71.62% |

| 2008 | $11.20 B | -53.93% |

| 2007 | $24.31 B | 0.47% |

| 2006 | $24.19 B | 10.68% |

| 2005 | $21.86 B | 46.03% |

| 2004 | $14.97 B | 63.71% |

| 2003 | $9.14 B | 56.89% |

| 2002 | $5.82 B | -20.46% |

| 2001 | $7.32 B |

ADBE Market Capitalization Over Time

Adobe’s revenue grew from $8.067B in 2018 to $11.182B in 2019. In the fourth quarter of 2018, Adobe’s revenue grew from $4.867B to $5.998B, a 29% increase year-over-year and a 17% increase in constant currency.

Adobe stock has now been increasing for four straight years and is currently trading at a price-to-earnings (P/E) ratio of 11 times, close to the average P/E ratio for Adobe stocks over the past three years (10).

Adobe Share price forecast for 2025. Here are the best and worst case scenarios for Adobe stock price in USD over the next decade.

Adobe Stock Forecast 2025: 01.01 — 04.20

By 2020, the stock price of Adobe Incorporated is expected to reach $658.2 a share (USD), which will be very close to $619.66 in 2018, which is also the forecasted level for this year and 2019 as well as after that period as well.

By 2025, the stock price of Adobe Incorporated will reach $704.98 a share (USD), which will be much higher from $645.85 a share (USD) expected in 2018, which is also predicted level for this year and 2019.

Advantages of Adobe Stock Forecast:

- The long term trend is above and with a long term downward movement;

- The long term downward trend can be driven by market forces, which is why it has been resistant to any serious attempts to reverse it;

- This downward trend can be prolonged by an increase in corporate earnings through acquisitions or revenue growth increases;

- When the upward trend becomes shaky, it will only take the form of an upward correction;

- The upward correction may not be strong enough to reverse the trend;

- A strong upward correction would lead to a new downward trend that would mean that there are fewer companies worth investing in than at present;

- There may be severe consequences if this downward trend does not reverse itself after such a strong upward correction;

- A stronger upward correction would mean that eventually there are fewer companies worth investing in than at present.

But when companies do eventually emerge again, they will take much longer to realize their full value because they have already missed out on some of their most profitable years during their previous downward movements e.g., Microsoft had many years where its share price was below current levels before eventually reversing its downward movement and becoming worth investing in again after such an upswing e.g., News Corp had several downswings before finally recovering back into high profit levels e., Warburg Pincus did so after below levels e., etc.; - A more pressing problem with an impending stock market crash is that it could lead to extreme financial devastation for many people especially investors who have invested heavily in stocks over long periods of time.