What are your thoughts on investing in the stock market or looking for few multibagger stocks?

You know, that thing where you buy stocks that pay dividends and then watch your money grow over time. These days, it seems like every day is a new opportunity to make some quick cash when you’re paying attention. But don’t let too many of these opportunities slip by!

Because while they might seem easy to find at first glance, after a little digging there’s no telling what could be lurking just below the surface. For example: did you know that GE has had more than its fair share of bumps lately?

I mean, sure the company was able to save face with its latest earnings report but if we take a look back at their past few reports it becomes clear how much trouble they are.

Facebook and Netflix just broke out!

It can be hard to predict the stocks of companies that will make a major breakout and become multibaggers. However, we find that some of the multibaggers of 2021 are able to continue their dream by predicting which stocks will have a breakout year in 2020.

We at SeoRub believe it is necessary for investors to look ahead and position themselves accordingly.

For instance, one way you could do this is by investing in stocks such as Facebook (FB) or Netflix (NFLX). These two companies have been on an upward trajectory over the last few years and we forecast they will continue this trend into 2020 making them prime candidates for investment success.

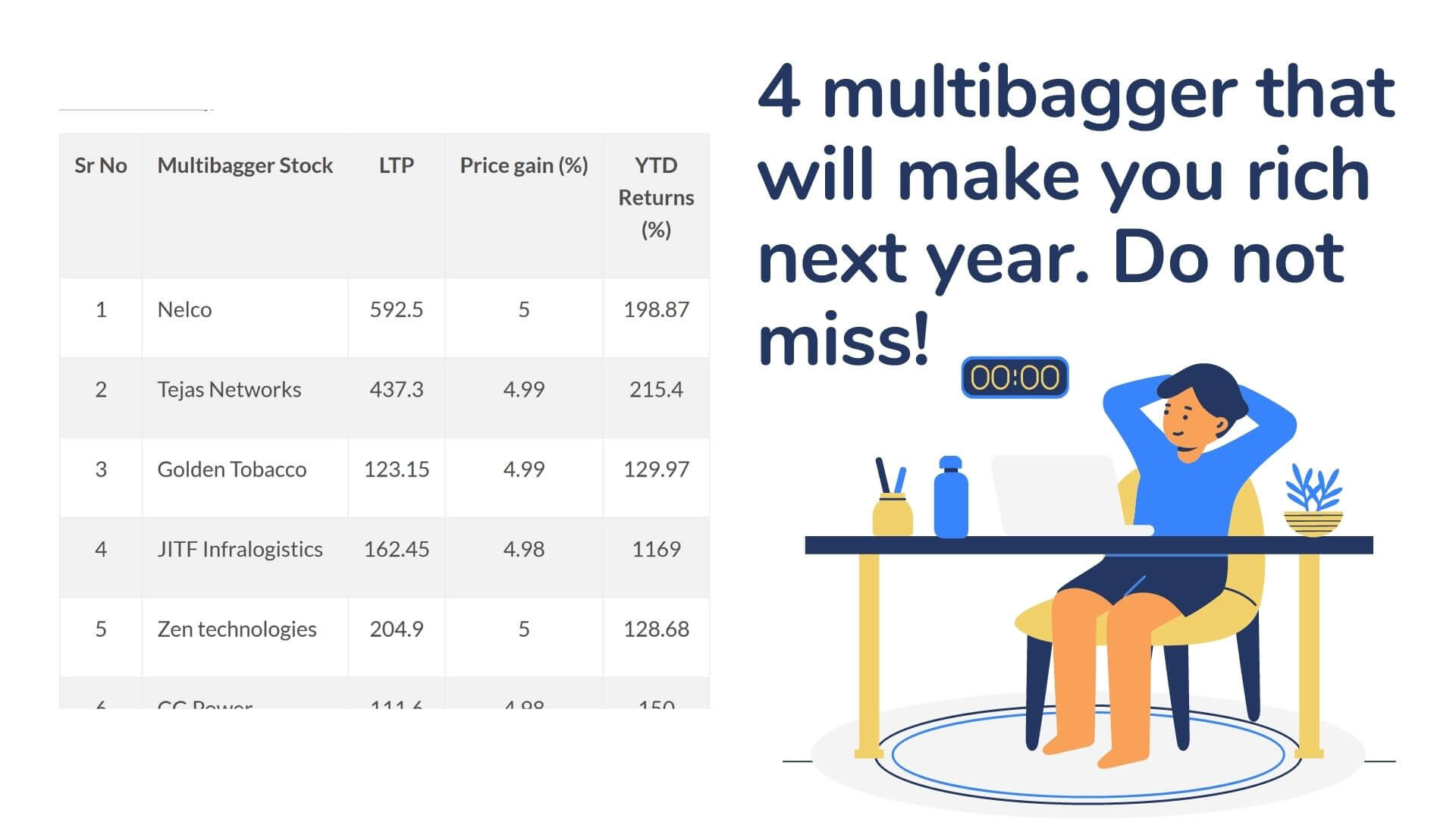

JITF Infralogistics Limited (JIL) – A Penny Stock To Catch

The global logistics industry is on pace to grow at a CAGR of 3.4% over the next five years, reaching $6.7 trillion by 2022. The JITF Infralogistics Limited (JIL) has emerged as one of the top multibaggers in this sector with its stock price up more than 18% year-to-date and it seems like there’s no end to the growth story for this company yet.

JIL is India’s first private sector player in warehousing solutions catering to both domestic and international clients across various industries such as FMCG, pharmaceuticals, apparel, engineering goods etc., through its network of 1 million sq ft warehouses spread across 50+ locations within India and abroad.

Nelco From Rs. 5 to Rs. 592 Price Range Stock

Nelco is a company that offers a variety of financial services. We offer mortgages, banking and credit card solutions to help people with their finances. Our blog posts will provide you with information on how to make the most of your personal finances.

Nelco’s stock has increased in price from Rs. 5 to Rs. 592, a 500% increase in the last 7 days.

This is not uncommon for stocks with low prices and high volatility, but Nelco has been listed on the stock exchange since 1999 and had never seen such a large rise before this week.

The company does not produce any products or services that would be considered “trendy”, making it difficult to pinpoint why their share price jumped so much without any warning signs until now.

It could be speculated that the recent fluctuations of other Indian stocks have caused investors to scramble for shares of companies they believe can grow quickly without too many risks involved because India continues to experience rapid economic growth while its currency remains stable relative.

Tejas Networks From Rs. 4.99 to Rs. 437 Price Range Stock

Tejas Networks is an IT Company that specializes in providing solutions for data centers, telecom networks and cloud computing. The company has been successful in growing revenues over the years with a compounded annual growth rate of 27%.

Tejas Networks offers three different product lines to cater to customer needs. These are Cloud Computing Services, Data Center Solutions and Telecom Networking Equipment.

With more than 1 billion people expected to be connected by 2020 – it’s no surprise that there is a huge demand for service providers like Tejas Networks who can deliver these services on a global scale. In order to keep up with this demand, companies need access to capital from investors or banks which requires them to have good credit ratings as well as positive long-term prospects of financial stability.

Golden Tobacco From Rs. 4.99 to Rs. 123 Price Range Stock

Tobacco is a subject that has been controversial for centuries, and the Indian government’s recent decision to increase taxes on tobacco products may not be the best solution.

Golden Tobacco Company’s stock price increased from Rs. 4.99 to Rs. 123 in just few days after it was learned that India will have one of the world’s highest tax rates on cigarettes, which could lead smokers to switch their habit or stop buying cigarettes altogether.

We had already explored what this means for Philip Morris International Inc., as well as other companies like British American Tobacco Plc and Imperial Brands Plc who use India as an export market for much of its business dealings with foreign countries such as Japan and China, where they make up 45%.