Learn here, how to use cancelled cheque for demat account to kick start the stock investment. We will explain the process to get a demat account for stock trading and portfolio creation as below.

Documents To Open A Demat Account For Stock Market

- Pan card – 1 photo copy as date of birth proof

- Aadhar card – 1 photo copy as address proof

- 6 months bank statement – Capability check for investment and historical transaction records to identify

- Cancelled cheque – For account link and bank account verfication

- 4 passport size photos – To make a record of the person or company

These are the basis records that are necessary for demat account opening. This will help to process the bank account with the demat account for stock or share market accessibility.

Nowadays, it’s very easy and smooth process but in last decade. To open an account for share market was very difficult. Only authorized and high profit businessman were eligible to open the account in stock market.

One account was able to trade on behalf of entire zone. Last time it was called as lalaji ka account. The person with big balance was able to open, trade and invest for long to get benefit.

But now, just one click with online banking, it’s very easy to go ahead.

Read more about : Cancel Cheque Image

How To Submit cancelled Cheque for Demat Account?

While submitting the proof then all above document need to be make a photo copy and submit but when regarding cancelled cheque submission for demat account then it’s little difficult to understand how to submit the cancelled cheque for bank account linking.

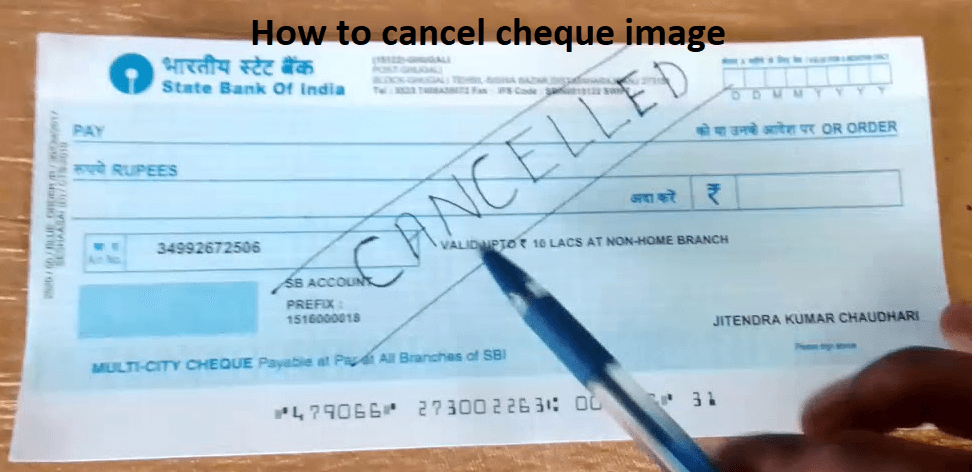

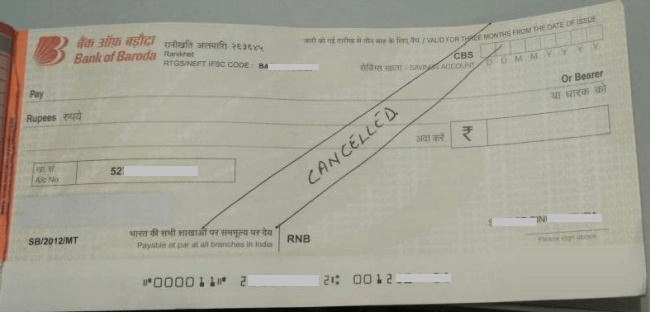

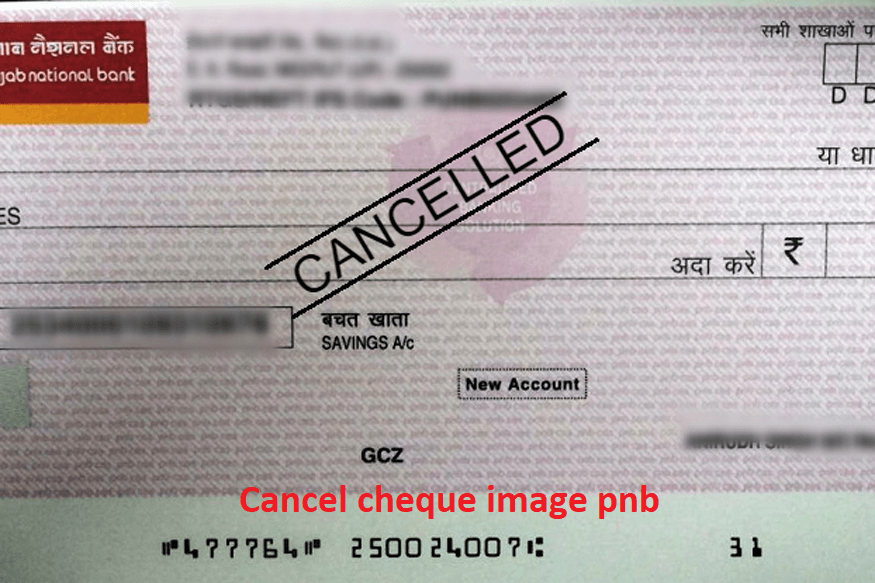

Here is the image of cancelled cheque for bank account linking as below:

In you cheque, you have mark double line with some space and then mark as CANCELLED in capital letter.

That’s it, then you have to submit to receiver of the bank employee. This will help you link you bank account with any fraud or misuse of the bank cheque.

Get the SBI Demat account here.

![11 Amazing [Hindu Marriage Biodata Format Docx] Free Template](https://seorub.com/wp-content/uploads/2021/10/11-Amazing-Hindu-Marriage-Biodata-Format-Docx-Free-Template-150x150.jpg)