When you are at bank, looking for how to write a bearer cheque? Or may be you don’t know about the term bearer cheque.

So, as per the name, Bearer cheque is an instruction of banking to pay off to payee or allocated person/organization for a specific amount by check (cheque).

Can bearer cheque be deposited in account?

It’s a common question asked by multiple users of SeoRub. Then answer is YES, bearer cheque you can in-cash directly to your account but the rule is all details mentioned on the cheque is similar to your bank account. If any single digit or comma is different then you will get the payment.

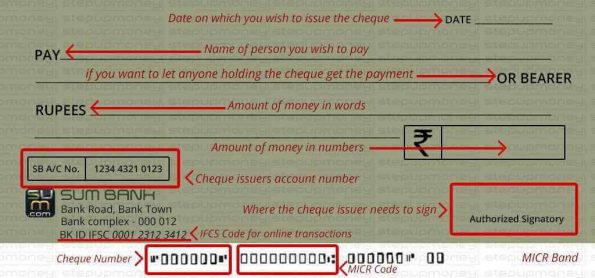

Bearer cheque sample

Might be still, you are not aware and looking for the sample of the bearer cheque sample, there here as below:

Process of filling the Bearer cheque

- As per the sample, date on which you wish to issue the cheque with day, month and year format

- Name of the person you wish to pay (Capital letter is most preferred)

- If you want to let anyone holding the cheque get the payment then use or bearer name

- Mark the exact amount of the value in words

- In the box, mention the amount of money in numbers only

- Check your saving account number once,

- Match your IFSC code number

- Above authorized signatory, mark your sign

- Mark your cheque number with MICR code

Cheque is available for Current and saving account holder. Ideally, cheque is a negotiable tool for banking.

Types of Cheques

Different type of cheque like bearer cheque, order cheque, open cheque, cross cheque, post dated cheque and others.

Cheque is giving guarantee to withdraw for a specific amount to pay off.

What is a Bearer Cheque?

Bearer cheque is using for cash withdraw from cash counter directly. A bearer cheque can be transferred to another person.

The bearer cheque is a type of check that does not require any identification from the person withdrawing money. Unlike other checks, there’s no specified withdrawal limit for this type of financial instrument.

In fact, the only way to stop someone from taking out more than what they have in their account would be to refuse them service or ask them for additional identification. If you’re interested in learning more about how these work and why people use them!

The best way to get money anonymously

You may have heard the term “bearer cheques” when referring to your bank account. What are they, and how can you withdraw money in this manner? Bearer cheques allow an individual to deposit them into their personal bank account without needing a signature or identification.

However, it is not possible for individuals to withdraw cash in this way. Instead, the bearer cheque will be converted into currency at the time of withdrawal if it has been endorsed by the owner on its back side with words like “payable to order” or “payable“.

The issuer needs only enough funds available at that moment in time for conversion. Keep reading our blog post about bearer cheques and find out more information about withdrawing money using these types.

What is the bearer cheque withdrawal limit?

The bearer cheque withdrawal limit is the amount of money that can be withdrawn from an account at one time. The limit varies depending on factors like where you live and what type of bank you are with.

For example: If you have a TD Canada Trust account in Ontario, your maximum withdrawal limit is $5,000 per day. If you have a BMO account in Alberta or Quebec, then your daily limit is $3,000.

There are other limits to consider as well- for instance some people might not be able to withdraw more than $2,500 without being verified by their financial institution first.

How can get cash payment of bearer cheque?

The process of exchanging a bearer cheque for cash. A bearer cheque is a check that is payable to whoever presents it at the bank or other place where it is drawn.

This type of financial instrument was commonly used in banking and monetary transactions before checks became more prevalent and widely used. They are also known as sight drafts, since they can be cashed “on sight”–that is, immediately upon presentation to the drawee (bank).

The process of converting a bearer cheque into cash usually starts with taking the physical document to an individual’s bank branch or sending it by registered mail. Once there, you would inform your banker that you wish to convert your bearer cheque into cash.

![11 Amazing [Hindu Marriage Biodata Format Docx] Free Template](https://seorub.com/wp-content/uploads/2021/10/11-Amazing-Hindu-Marriage-Biodata-Format-Docx-Free-Template-150x150.jpg)