Discover the untapped potential of option chains and elevate your trading game with expert analysis for maximum profits.

In the world of investing, having access to reliable and accurate information is crucial for making profitable decisions. Option chain analysis is a powerful tool that can provide valuable insights into the market sentiment and help investors uncover lucrative opportunities. By understanding how to interpret and analyze option chain data effectively, you can make more informed investment decisions and increase your chances of success.

Understanding Option Chains

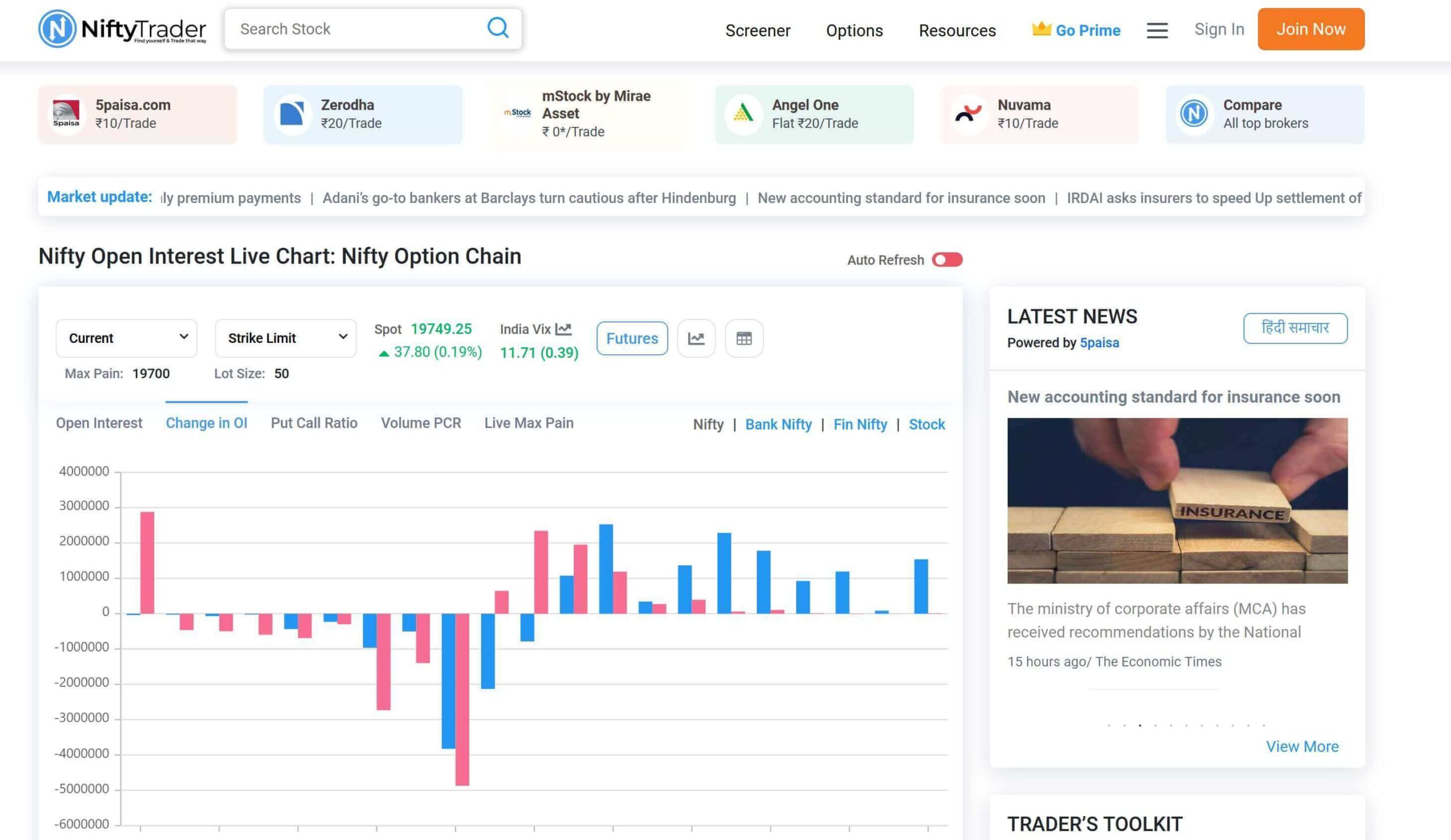

Before delving into advanced option chain analysis techniques, it is essential to have a solid understanding of what an option chain is and how it works. An option chain is a comprehensive list of all the available option contracts for a particular asset or security. It includes various data points such as strike prices, expiration dates, and option types (calls or puts).

By examining an option chain, investors can gain insight into the available options and their pricing. Key metrics such as volume and open interest can help determine market sentiment and the liquidity of specific options.

Basic Option Chain Analysis

Basic option chain analysis involves studying the option chain to identify the different types of options and understand their significance. One crucial aspect is categorizing options as in-the-money, at-the-money, or out-of-the-money.

In-the-money options refer to contracts where the strike price is lower (for calls) or higher (for puts) than the current market price of the underlying asset. At-the-money options have strike prices that are approximately equal to the current market price, while out-of-the-money options have strike prices significantly higher or lower than the market price.

Another essential factor to consider when analyzing an option chain is implied volatility. Implied volatility represents the market’s expectation of the future price movements of the underlying asset. Understanding implied volatility can help investors gauge the potential profitability of an option contract and assess the associated risks.

“Unleash the power of option chains and master advanced analysis to unlock limitless profit opportunities. Dive into the insights and strategies in this must-read blog post that will revolutionize your trading game!

#Options #TradingTips #ProfitOpportunities

Advancing Your Option Chain Analysis

To enhance your option chain analysis, it is crucial to explore advanced techniques and metrics. One of the key metrics is the Greek values: delta, theta, gamma, and vega.

Delta measures the rate of change in the option price concerning a change in the price of the underlying asset. Theta quantifies the time decay of an option’s value, indicating how much the option’s price will decrease as time passes. Gamma represents the change in delta concerning a $1 change in the price of the underlying asset. Vega measures the option’s sensitivity to changes in implied volatility.

By applying these metrics, investors can gain deeper insights into the potential risks and rewards associated with different option contracts. It allows for more precise analysis and decision-making based on the specific characteristics of each option.

Utilizing Advanced Option Chain Tools

Several online platforms and software tools offer advanced option chain analysis features to assist investors in making informed decisions. These tools provide real-time data and customizable filters to help investors narrow down their options based on specific criteria.

Advanced option chain tools also offer comprehensive charting capabilities, allowing investors to visualize the relationships between option prices, underlying asset prices, and other variables. By utilizing these tools, investors can make more accurate predictions and identify potential profit opportunities.

When choosing an advanced option chain tool, it is important to consider factors such as reliability, user-friendly interface, and compatibility with your particular trading strategies and goals. Some popular and highly recommended options include XYZ Option Analyzer, ABC Option Screener, and DEF Option Analytics.

Conclusion

In conclusion, option chain analysis is a powerful tool that can help investors uncover profitable opportunities in the market. By understanding the different components of an option chain and utilizing advanced analysis techniques and tools, investors can make more informed investment decisions and increase their chances of success.

Remember to start with a solid understanding of the basic concepts of option chains, such as strike prices, expiration dates, and option types. Then, explore advanced techniques like delta, theta, gamma, and vega analysis to gain deeper insights into option movements. Utilize reliable and user-friendly advanced option chain tools to enhance your analysis and make more accurate predictions.

By mastering advanced option chain analysis, you can unlock the potential for higher profits and achieve greater success in your investment endeavors.