This is an article about the benefits and downsides of wire transfers and how they compare to other methods of transferring money. Does green dot bank accept wire transfers in 2022? The simple answer is that NO.

Green Dot Bank does not process international wire transfers for individuals, though they offer other methods of transferring money that should meet all your needs.

Let us review the benefits and limitations of wire transfers in general before looking at some specific banks’ policies on this subject.

What is a wire transfer?

A wire transfer is a service offered by banks and other financial institutions that allows customers to send money across the country or internationally. The process for transferring money can vary depending on the institution that both parties use.

But typically it involves the sender filling out the necessary information and authorizing the transfer, which is then sent electronically to the recipient’s bank. Wire transfers are different from checks because they’re instantaneous and also cost more.

How to make an outgoing wire transfer?

- Open the website for the receiver’s bank (for example, Wells Fargo or Citibank) and select Wire Transfer from the list of options.

- Provide your name and phone number.

- Provide the sending account number and name on the account, as well as the recipient’s name and address (or choose to fill out a biller code).

- Choose whether you want an email confirmation of the transfer or not.

- Confirm all your details and confirm your request, specifying whether you want to limit transactions to $25,000 per day and/or $50,000 per month.

Why do people still send wires?

Wire transfers are the most expensive and slowest way of sending money between banks. Fees usually hit the $40-50 range, which is prohibitively high for small amounts.

On top of that, wire transfers take 3-4 business days to process; weekends and public holidays don’t count, so your recipient will have to wait a full week to get her money.

That is why wire transfers are used only for large amounts of money, while most people prefer other methods for their day-to-day expenses.

What are the benefits of wire transfers?

The biggest advantage of wire transfers is that they can be sent even when you don’t know the branch or account number of the receiving party.

If your family in another country needs money to pay bills, they can use a wire transfer without worrying about which specific account to use (unless they manage their finances online).

Another big plus of wire transfers is that you don’t need to be at home or even pay any attention to them; the money arrives on time and the receiving party can use it immediately.

How to receive an incoming wire transfer?

US Bancorp doesn’t have an official page for wire transfers, but customers are allowed to use third-party institutions. You can find a list of all the available banks on this link.

How to receive an incoming wire transfer?

- The recipient will need to provide their account number and routing number (if applicable) – this information should come with your bank statement.

- Contact US Bank Customer Service at 1-800-872-2657, 5:00 AM EST – 10:00 PM EST Mon.-Fri., 6:00 AM EST – 9:00 PM EST Sat. or Sun., for your banking institution or visit their website for more information on how to accept incoming wire transfers.

Which banks accept wire transfers?

If you look for a bank that accepts international wires, you will quickly find out that only large financial institutions offer this service; smaller banks and local credit unions do not support wire transfers.

Since they’re so expensive and time-consuming, wire transfers are reserved only for big transfers.

Bank of America, for example, charges $30 to send a wire and $33 to receive one (plus a 3% currency conversion fee). It takes 2-3 days for the money to arrive at the other bank. The sender must pay attention to potential differences in time zones; it could take an additional day if your recipient is located in a different country.

B of A customers that need to send money usually give the following instructions: “Call our customer support on 1-800-732-9194 or, if you are outside the US or Puerto Rico, call collect on 1-403-262-4058 and provide your name and phone number”.

Which are banks allowing to use of third-party institutions for financial transfer?

Chase doesn’t have an official page for wire transfers, but customers are allowed to use third-party institutions. You can find a list of all the available banks on this link.

Ally Bank is one of the few financial institutions that accept international wires – you only need to call their customer service department at 1-877-247-2559 and provide all the necessary details. Once your wire is processed, the recipient will get the money within 2-3 days.

Bank Charges on Outgoing

Ally charges $20 for outgoing wires and $15 for incoming ones.

USAA limits its international wires to only three countries: Mexico, Germany, and the UK (some of their customers have reported sending wires to other European countries, but it is not the official policy).

For an outgoing international wire transfer, you will pay $30, plus currency conversion fees. It takes 2-3 business days for the money to arrive in the receiving bank. The receiving party must have a USAA account too.

USAA charges $15 for incoming wires, plus currency conversion fees. It also takes 2-3 business days for the money to arrive at the receiving account.

Other Bank Charges

SunTrust Bank is one of few institutions that offer free international wire transfers. You can make an outgoing transfer (for which you will need to provide all the necessary details) and pay no fee, not even currency conversion charges. All incoming wires are also free of charge.

SunTrust allows free international wire transfers from any US bank to more than 200 countries and territories worldwide, while the receiver can be a customer of almost any bank.

You will be charged $15 for outgoing wires and $9 for incoming ones if you’re not a Suntrust customer (the minimum transfer amount is $50).

Wachovia doesn’t have an official page for wire transfers, but customers are allowed to use third-party institutions. You can find a list of all the available banks on this link.

Wachovia charges $10 for outgoing wires and it takes 1-2 business days for the money to arrive in the recipient’s bank account. The sending party must call 1-888-922-4684 to provide all the necessary details and wait for a confirmation from Wachovia’s representatives, who will then initiate the wire transfer.

Incoming wires are free of charge

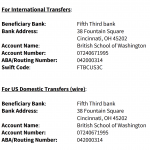

Fifth Third Bancorp is one of few financial institutions that offer international wire transfers. You can use Western Union or any other third-party institution to send money.

The recipient must provide the following details: name, date of birth, ID type and number (passport, driver’s license).

You will pay $30 plus currency conversion fees for outgoing wires. It takes 2-3 business days for the money to arrive in the recipient’s bank account.

Fifth Third charges $15 for incoming wires and it takes 2-3 business days for the money to arrive at the receiving account.

US Bancorp doesn’t have an official page for wire transfers, but customers are allowed to use third-party institutions. You can find a list of all the available banks on this link.