The critical financial situation of India by making bank fraud and every year country loss. That’ why, we come across, banking frauds in India case study to mark the pointers to save financial freedom of India.

Finance and economics is the boon of any country. In this year, most of the banks had faced the NPA frauds. Here is the top 5 banking frauds in India case study that loan drop-down the hands and CEO of company forced to leave after bank fraud.

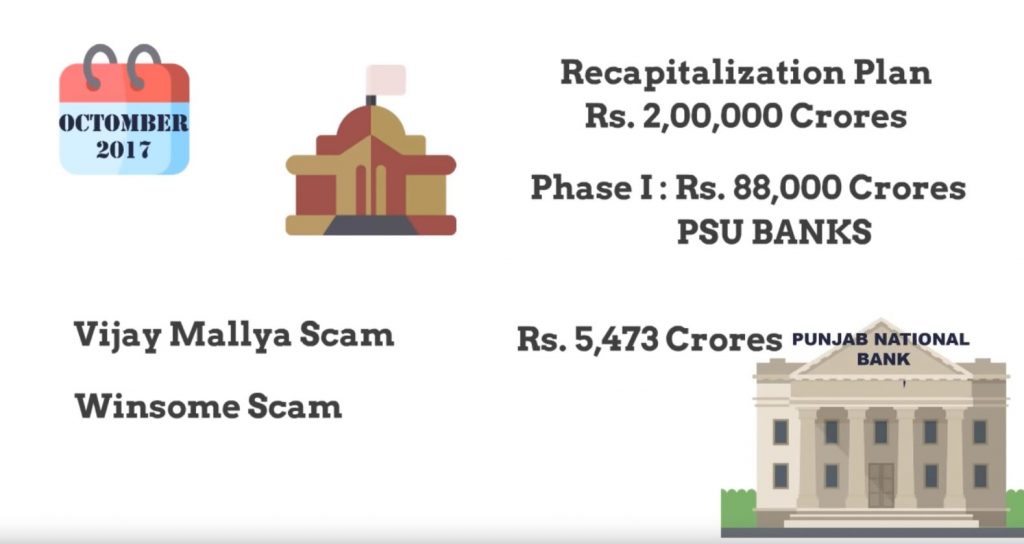

The big businessman is taking loan from banks and then after they are not known and then walk away from the country. The biggest example is “Nirav Modi” and “Vijay Mallya“.

I think these are the two name that you heard about it but more than that is already available in the market with the banking frauds in India case study.

Here we are going to talk about them that one hampering the market of Indian financial system by banking frauds in India case study:

There are 6 big names for the financial system that actually exist from there and then hampered the Indian financial economic system and broke down the backbone of normal and common people of India.

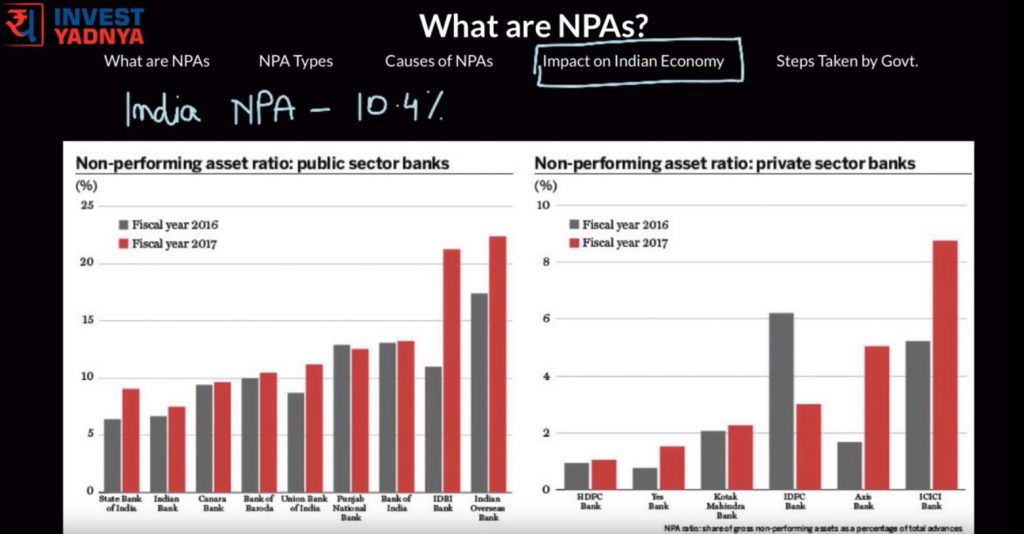

What are the impact if Non Performing Assets (NPA) are High?

The reason is that if that particular loners are not giving the loan there after that Patloon capability and due amount was to be paid by common citizen of India.

That’s why in this article we are going to talk about that what are the biggest name that actually happening these activities for the banks is not performing assets.

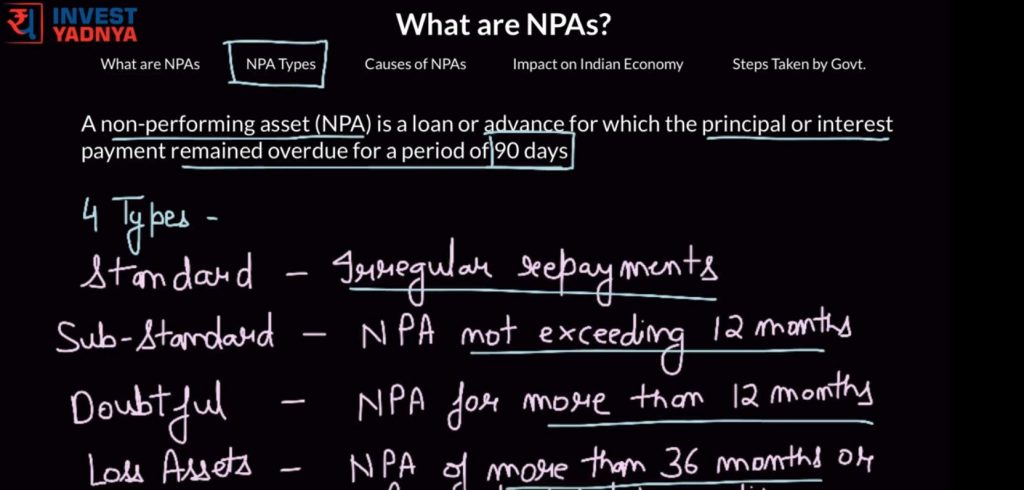

What is NPA (Non Performing Assets)?

I hope you heard about npa actually that were known as not performing asset for banks.

Banking system is working on the lending money and backbone of banking system. Once bank is approving the loan then after they can get the interest of it. It’s the main source income of banks.

So whenever they are giving the loan to someone and then after they not returning then in the condition bank is not making any kind of profit from them. That’s why these kind of acid is called as non performing assets.

Here is the list of six big name that actually hampered the economic system.

6. The Nirav Modi scam 2018

Nirav Modi is the name that actually get the money from India and then walk away towards London.

The most biggest name into the Diamond Jewellery section of India. He is the biggest manufacturer and creator of diamond jewellery supply and manufacturing chain dealer.

Gitanjali is the biggest name of India in the section of jewellery.

More than thousand outlets all over the India of Gitanjali has today right now due to this nirav Modi scam.

He just borrow more than 14000 crore rupees from Punjab National Bank PNB and then after he just make the fraud and walk away from India.

The latest news is that Nirav Modi is in arrest of London police.

5. The second biggest scam is Chanda Kochhar scam

As we all know that Chandra kochar is the ex ICICI Bank CEO and the biggest name of Indian financial system.

She had left the post of ICICI Bank after more than 26000 crore rupees of scam. Express news was not big because iCICI Bank brand had diluted that particular news from news Agencies and the system.

Chanda Kochhar had made most of the decision regarding the non performing Assets and diluted that particular financial values as null.

That’s why most of the cases no any person has been marked as suspicious victim of that particular scam.

It was well planned master game by ex CEO of ICICI Bank Chanda Kochhar.

But right now she had left the job and move from the country as same as Nirav Modi and Vijay Mallya.

This is very sad because chandra khochar was the winner of Padmashree award. She was the most respected women into the financial system of India.

But money stays with the name. Right now the bad name is continue with Chanda Kochhar. We hope that she will come soon and return the money of india as soon as possible because Indian government is working on it and ICICI bank is going to corporate on that particular and non performing asset system.

4. Shikha Sharma the ex CEO of Axis Bank made the scam of 23000 rupees

Shikha Sharma was the ex cEO of Axis Bank till 2018. She had worked very well but right now in 2018 she was marked as a scammer of more than 20000 rupees.

It’s not there but definitely the cases are going into the court and she is not working with Axis Bank anymore.

It can be a clever game by some Businessman but it is not there that she had made any mistakes till now.

But the truth remain the same is that Indian government had lost 23000 rupees from Axis Bank. And zero recovery possible till now.

Sharma was a private sector company that she had send the money to was real estate owner without any verification and justification of the papers.

Right now there was no identity by that real estate owner. And money was somewhere else.

It was totally that we can say that she is the victim but definitely the mistake had been done by the ex CEO of Axis Bank.

3. Rana Kapoor ex CEO of Yes Bank

Rama Kapoor was it passed out the most intelligent and respectable person who had named as the fraud and a scammer person of Yes Bank.

He was assigned as a CEO of Axis Bank in 2017 beginning. But he never knows that the opportunity already remains the same. He had made the scam of 4300 crore rupees the 2019 beginning.

Rana Kapoor was the ex RBI member. And the professor of lord Oxford university of London.

The claim was that he had given lots of money towards several lenders including Yes Bank close that name towards the bank.

The overall loss was 8300 crore rupees. Still no recovery has been possible in the Judiciary system will accuse the person. He is not continuing the job with Yes Bank anymore but yes another fraud any scam happened with the common people of India.

2. RBI Governor urjit Patel left the job

This is the most shocking news india because RBI Governor urjit Patel left the so post in 2019 January without any reason.

Who is the truth but that he had made looks of into the system and that’s why Indian government moved towards another department and made the resignation possible as soon as possible.

He had given lots of lending money towards the Businessman without any verification of documentation and justification.

On behalf of that he had made multiple errors of documentation. Shiva The recommendation suggest by the government had not applied so that’s why he had left the job of RBI governor.

This was the most shocking news no one verified that what was the reason but definitely it’s true that something is not happening well into the system of RBI.

1. SMS bank scams with common people of India

As per the record of GDP of India is that most of the scam is happening to SMS.

Towards the mobile and telling that you have to update your Aadhaar number. This will cause bank scams and common people will loss their money on it.

You just click the website link and then after fill out your Aadhaar number and then your Aadhaar link with account and you don’t have to pay anything for the loan.

When you fill the form and giving your Aadhaar number and providing that valuable information to what’s the website then after brother SMS will come and tell you that you have to apply for loan of 500000 Rupees with documentation of certain things.

Vamsi of light with the documentation on that particular website then after they are asking you 15000 rupees to process the loan.

All the system has been made by the complete on system you don’t have to do anything.

It seems like it’s truly professional but as a scam and it was meet in 2019 with more than 100000 customers of Central banks.

The cause was that most of the person is very friendly with online system and the handmade 15000 rupees learning process because they want loan as soon as possible.

But after that 15000 rupees of deposit am not getting that particular loan ever and the scam happened.

The protective amount of a scam was around 1000 crore rupees with the citizens of India.

So my dear friends these are the few cases and scams has been happened in 2019 this is just a guideline to you that you have to follow our news channel and follow the system to get the latest informational news of financial update.

Banking frauds in India case study – What can we do to prevent from PNB scam?

This is scams will happening because you are not aware. The final verdict will be coming to us because we have to pay that money if someone walk away from the India then that money we have to pay in our life as taxes and other charges.

The effect of this particular scams was that Indian government is can’t work towards development and funding a system. It was banking frauds in India case study. Hope you like it.

Be aware about that and find out the latest news and updates with our systems right now thank you very much.

Their are multiple types of scams like central fraud registry RBI. These things will cause insecurity regarding financial institutions. May be share will go down if SBI fraud or HDFC scam will into the picture.

Banking Frauds in India – A Business Risk

A banking fraud is an act of fraud that involves the misuse of a bank’s money (or monetary resources), or the use of a bank’s services, such as account opening and withdrawal, without the written informed consent of the bank.

A fraud may be committed with regards to money that has been deposited by an individual, which is then subsequently used for personal gain (such as for an investment or purchase) or for other purposes. It may also be committed with regards to any other kind of financial asset.

Type of Banking Frauds

There are various forms of frauds that fall under this category. Some of these include:

- Conversion Fraud: The conversion of a real asset into a fictitious one. For example, when someone deposits money in an account to buy a house, it is known as conversion fraud; there is a false entry in the record that shows the amount deposited as having been converted into equity when in actuality it was merely transferred to the owner’s account;

- Counterfeiting: The counterfeiting or alteration of one form of currency into another; this includes printing and cutting up so-called “fraud notes” and altering currency notes printed with security features to allow them to pass through airport scanners (as opposed to counterfeiting paper currency);

- Fraudulent creation/misrepresentation/distribution/exchange of assets: Lying about who has ownership rights over an asset or what assets have been made;

- Fraudulent conveyance/transferring ownership without adequate transfer documents: Falsifying transfer records or documents relating to property transfers (e.g., deeds);

- Misappropriation/misappropriation from others’ accounts: Taking from someone else’s accounts without allowing others equal access;

Banking Frauds in India – A Social Cost

In the year 2006, a group of banks was involved in a fraud in the form of Bank Credit Card Fraud (BCCF) wherein the bank managers used their positions to take advantage of customers. They did this by making false promises and promises that would allow them to generate revenues for themselves. Many people were deceived into believing that these banks could provide services that would return good returns for their investments. In fact, these banks were profit-oriented and did not treat customers as such.

As a result, many people lost money because they did not have enough information before they signed up with these so-called financial institutions. The problem was exacerbated because the bank managers had no real experience in banking and thus failed to know when something is right or wrong. The customers who invested their hard earned money in these banks went broke because they had no way of knowing what was really happening with their money.

Banking Frauds in India – A Financial Cost to the Economy

Indian Banks are being hit by a serious fraud problem. This was brought to the notice of the Indian banking regulator, the Reserve Bank of India (RBI) in 2014 .

This is a serious problem since banks are in the business of safeguarding and protecting the public. There is a reason for it. Banks all over India have been caught red-handed by fraudsters.

First, it happened in 2008. This was called ‘the Indian banking crisis’. The frauds were carried out by a group of people who came from Mumbai and were mostly involved in real estate business. In 2011, two other groups were caught with similar modus operandi as well. They got into banking frauds with loans worth Rs 30 crore to Rs 100 crore each.

By 2016, four groups indulged in fraudulent activities together amounting to Rs 1,000 crore. It is estimated that their losses could have been as high as Rs 2,000 crore!

The RBI has taken up this issue seriously and has sent out notices to 11 key banks including State Bank of India (SBI), ICICI Bank, Punjab National Bank (PNB) and Allahabad Bank asking them to explain their banking practices which had led to this huge loss to the economy:

It’s not easy being a bank these days – especially when you’re being attacked by fraudsters for not doing enough! It’s certainly not news that Indian banks have been hit hard by frauds recently.(The Times of India) So we decided to write an article about these genuine financial losses incurred due to suspicious financial transactions . We would like this article to be published on our blog so that readers can make informed decisions about which bank is willing and able to lend money at low rates .

Our blog will also help readers learn more about what kind of investments they can make with their hard-earned money after understanding the source for their funds . We hope you will share this post on your social media accounts if you feel inspired enough ! Don’t forget that our post will be updated regularly with more cases ! We don’t want our readers thinking that all banks are guilty – but we do think some banks should be informed about such issues so they can take steps against these fraudulent activities better than others ! Earlier this year , RBI had announced a crackdown on certain financial institutions , which included SBI , ICICI Bank and PNB , citing as reasons high losses on loans given by these institutions .

The banking frauds in India case study was developed to highlight the indictments made against the Indian banks and their executives. These indictments include charges of fraud, embezzlement, bribery, insider trading and creating a “shadow banking system”. The cases have led to allegations of wrongdoing by top executives at India’s largest banks.

The articles are published on The Nation, Business Standard, Mint and The Economic Times.

The author is an investment professional with a Masters Degree in Finance from IIT Delhi and is currently working as an Associate Manager at BNP Paribas Investment Partners (Singapore). He has also worked for various investment banks in Asia.