Get Detailed Information about Fifth Third Bank International Wire Transfer Instructions.

Fifth Third Bank is one of the most reputable banks in America and they offer many different banking options for individuals. One such option involves receiving international wire transfers, which can be done by following these steps:

- Understand that you’ll need to contact your sender’s local FifthThird branch

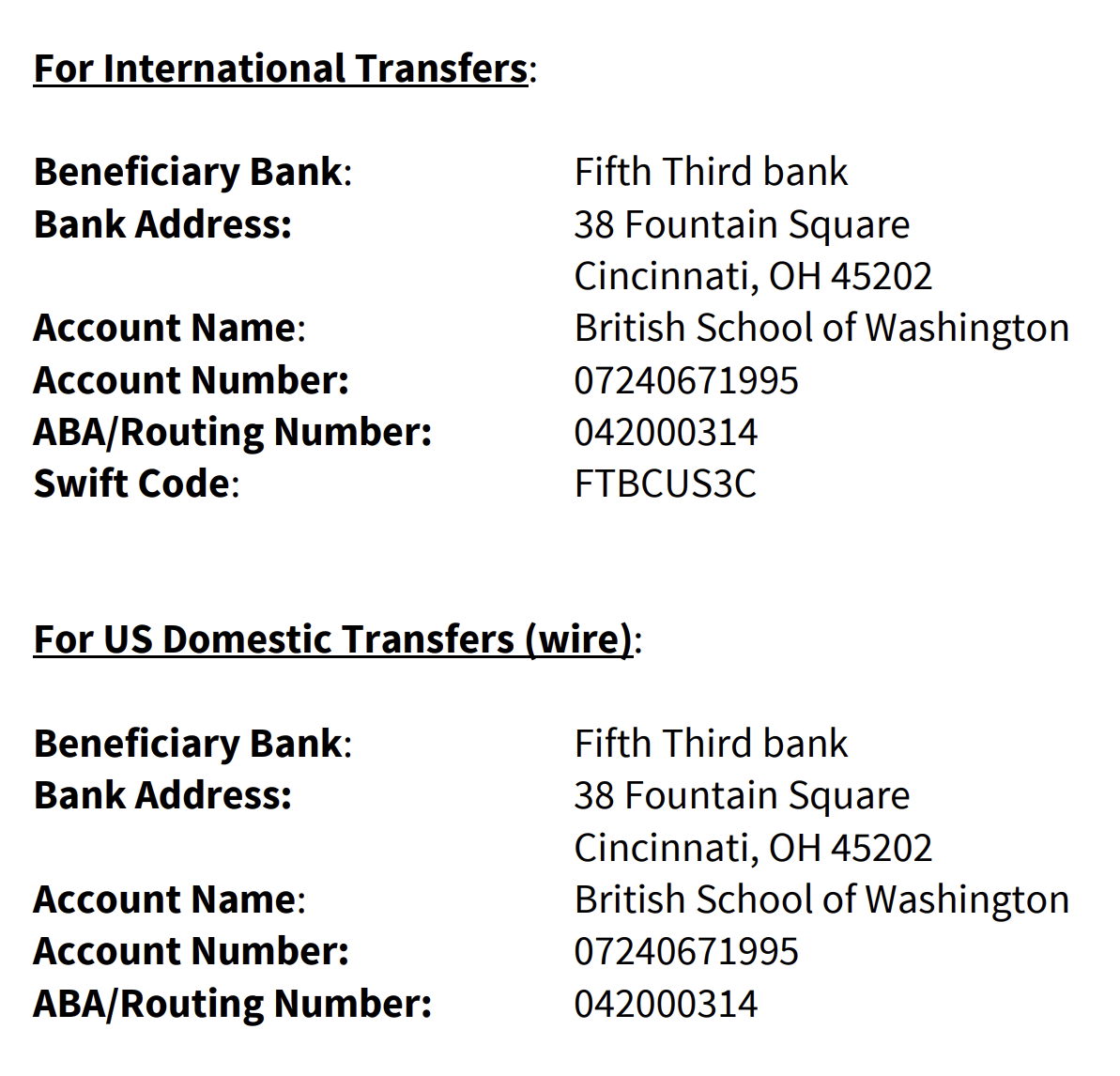

- Provide them with all of this information – specifically any SWIFT codes or routing numbers

- The financial institution will then route the funds accordingly

- And finally, deliver it on time

Your name and full account number (including any zeros at the beginning). You can find all of this on our website or by calling 1-800-555-5555. In addition to that, we also require a routing code which is found in most banks’ customer service departments as well as their SWIFT code for electronic payments made using Federal Reserve notes across borders between countries other than US Dollars alone.

Information to receive an international bank transfer

Need the following information:

- The name and address of the recipient

- The number of the account to transfer the money to (this must be accurate otherwise it will end up in a different account)

- The SWIFT code for the particular bank

- The amount of money that is being wired (in US dollars)

- The date and time when the wire should take place

- Any other requirements your financial institution may have

Introduction About The 5/3 Bank

Fifth Third Bank is a diversified financial services company with one of the largest networks in the Midwest. Fifth Third provides a complete range of banking, brokerage, and insurance products and services to individuals, corporations, and institutions.

The Company operates primarily under two brands: Fifth Third Bank, which provides commercial lending and other banking products to small-to-medium size businesses; and Blue Chip Financial Services (BCFS), which offers investment advisory, fiduciary management, brokerage, and retirement plan services (including 401(k) plans).

BCFS is authorized by the U.S. Department of Labor as an ERISA fiduciary that may provide discretionary advice for individual participants’ account balances up to $250,000 in many types of retirement plans.

Conclusion

Write an article brief that explains how to send money internationally. It’s a very easy, and relatively inexpensive way to send a large sum of money overseas. You can take your cash to a bank or use a service like Western Union for this task. Keep in mind that the cost will vary based on the amount you’re sending, so do your research beforehand!

A lot of people are now using online services to send money internationally. For example, the company Transfermate will have you fill out a simple form with your bank account number that holds the money to be transferred. The recipient’s name and bank account number that they would like to receive it into, and the amount being sent. The money is then sent to whichever one of their 12,000 global partners they have on file. That means you have plenty of options for which banks or institutions will deliver your transfer overseas.