How to Learn Stock Market Trading in India

The stock market can be a great way to invest your money and grow your wealth. However, it can also be a risky investment, so it’s important to learn how to trade stocks before you start investing.

This guide will teach you everything you need to know about stock market trading in India. We’ll cover topics such as:

- What is the stock market?

- How to choose a stock broker in India

- How to open a trading account

- How to deposit money in your trading account

- How to place a buy order

- How to place a sell order

- How to track your investments

- How to manage your risk

- How to trade successfully

By the end of this guide, you’ll have a solid understanding of how to trade stocks in India. You’ll be able to make informed decisions about your investments and start growing your wealth.

II. What is the stock market?

The stock market is a place where people can buy and sell shares of companies. When you buy a share of a company, you become a part-owner of that company. The value of your shares can go up or down depending on how well the company does.

The stock market is a great way to invest your money and grow your wealth. However, it is important to remember that there is always risk involved when investing in stocks. You could lose money if the company you invest in does not perform well.

If you are interested in learning more about the stock market, there are many resources available to you. You can read books, articles, and blogs about the stock market. You can also take courses or attend seminars.

The stock market can be a confusing and intimidating place for beginners. However, if you take the time to learn about it, you can make it a profitable investment.

How to choose a stock broker in India?

When choosing a stock broker in India, there are a few things you should keep in mind.

- The broker’s fees and commissions

- The broker’s trading platform

- The broker’s customer service

- The broker’s reputation

You should also make sure that the broker is registered with the Securities and Exchange Board of India (SEBI).

Here are some of the best stock brokers in India:

- ICICI Securities

- Kotak Securities

- RBL Securities

- Angel Broking

- 5paisa

You can learn more about these brokers by reading our reviews of the best stock brokers in India.

Steps to choose a stock broker in India

When choosing a stock broker in India, there are a few factors you should consider. These include:

The broker’s fees and commissions. Make sure you understand what fees and commissions the broker charges, and how they compare to other brokers.

The broker’s trading platform. The trading platform is the software that you will use to trade stocks. Make sure the platform is user-friendly and has all the features you need.

The broker’s customer service. If you have any questions or problems, you need to be able to get in touch with someone at the broker who can help you.

The broker’s reputation. Do some research to see what other people have said about the broker. Are they trustworthy and reliable?

Once you have considered these factors, you can start narrowing down your choices. There are many reputable stock brokers in India, so you should be able to find one that meets your needs.

How to deposit money in your trading account

To deposit money into your trading account, you will need to log in to your broker’s website or mobile app. Once you are logged in, you will need to find the “”Deposit Funds”” or “”Add Funds”” section. You will then be able to enter the amount of money you want to deposit and select your payment method.

The most common payment methods for depositing money into a trading account are bank transfers, debit cards, and credit cards. Bank transfers are usually the most convenient option, as they are typically free and can be processed quickly. Debit cards and credit cards are also convenient, but they may incur fees.

Once you have selected your payment method and entered the amount of money you want to deposit, you will need to click the “”Deposit Funds”” or “”Add Funds”” button. Your funds will then be deposited into your trading account within a few business days.

How to place a sell or Buy order?

To place a sell order, you will need to log in to your trading account and select the stock you want to sell. You will then need to enter the following information:

- The number of shares you want to sell

- The price at which you want to sell the shares

- The type of order (market order, limit order, or stop order)

Once you have entered all of the required information, you can submit your sell order. Your order will be executed once the stock reaches the specified price or when the market closes.

Here are some tips for placing sell orders:

- Use a limit order if you want to ensure that your order is executed at a specific price.

- Use a stop order if you want to sell your shares if the price drops below a certain level.

- Be aware of the fees associated with placing sell orders.

By following these tips, you can increase your chances of successfully placing sell orders and making money from your investments.

How to manage your risk?

Managing your risk is an important part of stock market trading. There are a number of things you can do to manage your risk, including:

- Diversifying your portfolio

- Using stop-loss orders

- Setting a budget

- Keeping your emotions in check

By following these tips, you can help to protect yourself from losses and make sure that your trading is sustainable over the long term.

Here is a more detailed explanation of each of these risk management strategies:

- Diversification is the process of spreading your investments across different asset classes, industries, and companies. This can help to reduce your risk of loss if one of your investments performs poorly.

- Stop-loss orders are orders that automatically sell your stock if it reaches a certain price. This can help to protect you from further losses if the stock price continues to fall.

- Setting a budget can help you to stay disciplined and avoid overtrading. It is important to know how much money you can afford to lose before you start trading.

- Keeping your emotions in check is one of the most important aspects of risk management. When you are trading, it is important to be objective and make decisions based on facts and data, rather than emotions.

By following these tips, you can help to manage your risk and make sure that your trading is sustainable over the long term.

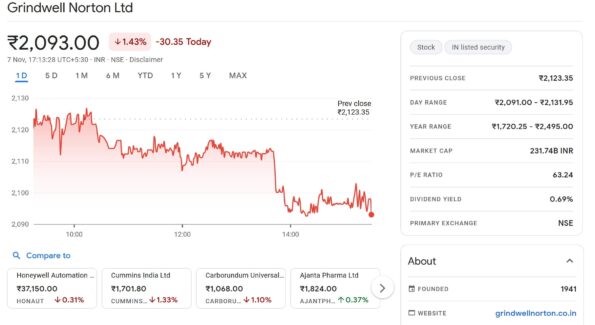

How to track your investments

Tracking your investments is an important part of stock market trading. It allows you to see how your investments are performing over time, and to make adjustments as needed. There are a number of different ways to track your investments, but some of the most common methods include:

* Using a stock market trading app or website

* Using a spreadsheet

* Using a financial advisor

Using a stock market trading app or website is one of the easiest ways to track your investments. Many stock market trading apps and websites offer real-time quotes, so you can see how your investments are performing at any given moment. Some apps and websites also offer charts and graphs, which can help you to visualize your investments over time.

Using a spreadsheet is another option for tracking your investments. This method is more manual than using a stock market trading app or website, but it gives you more control over how your investments are tracked. You can create a spreadsheet that tracks your investments by company, by price, or by any other criteria that you choose.

Using a financial advisor is another way to track your investments. A financial advisor can help you to create a financial plan, and can also help you to track your investments over time. A financial advisor can also provide advice on how to make adjustments to your investments as needed.How to manage your risk

Managing your risk is an important part of stock market trading. There are a number of things you can do to manage your risk, including:

Diversifying your portfolio: By investing in a variety of stocks, you can reduce your risk of losing money if one stock or sector performs poorly.

Using stop-loss orders:- A stop-loss order is an order to sell a stock if it falls below a certain price. This can help you limit your losses if a stock starts to decline.

Taking profits when you have them: – Don’t be afraid to take profits when you have them. This can help you lock in gains and reduce your risk of losing money if the stock price declines.

By following these tips, you can help manage your risk and increase your chances of success in the stock market.”