There are many auto support and resistance indicators available on TradingView, and the best one depends on your trading strategy and preferences. However, here are some of the most popular and widely used auto support and resistance indicators on TradingView:

- Pivot Points: Pivot Points are calculated based on the previous day’s high, low, and close price. These levels can act as support and resistance levels.

- Fibonacci Retracement: Fibonacci Retracement levels are calculated based on the Fibonacci sequence and are used to identify potential support and resistance levels.

- Moving Averages: Moving Averages are trend-following indicators that can also act as support and resistance levels.

- Ichimoku Cloud: The Ichimoku Cloud is a comprehensive indicator that includes multiple components, including support and resistance levels.

How these indicators are working?

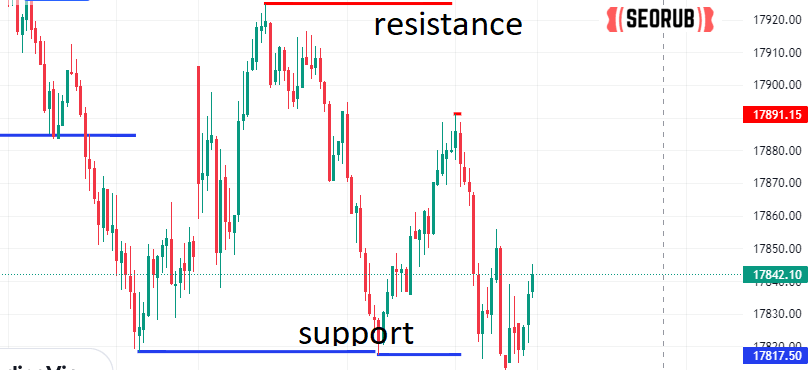

Auto support and resistance indicators work by analyzing past price movements and identifying levels where the price has previously found support or resistance. These levels are then marked on the chart, making it easier for traders to identify potential entry and exit points.

These indicators use different calculations and formulas to identify support and resistance levels, but they all aim to identify key price levels that are likely to influence future price movements.

Overall, auto support and resistance indicators can be a useful tool for traders, but it’s important to remember that they are not foolproof and should be used in conjunction with other technical analysis tools and fundamental analysis to make informed trading decisions.

Introduction

One of the most revealing insights that customer research can give is how your customers perform in different situations.

For example, a customer who has just upgraded to a new product might be more likely to resist suggestions to return their old product than one who has been using the same product for years.

By understanding how resistance indicators are drawn up, you can better understand when it’s time to offer support and when it’s not.

Auto Support and Resistance Indicators

Auto support and resistance indicators are devices used to measure the amount of force required to start, stop, or change a tire. They are usually placed on the ground in front of the vehicle to allow drivers to see how much effort is needed to move the car.

Resistance indicator devices use a different type of gear wheel which spins around an axis that relates to the resistance of the tire.

What are Auto Support and Resistance Indicators Used For?

Auto support and resistance indicators are used to indicate the state of the car or motorcycle. They are used during fuel injection, drive, and maintenance operations. The indicator will change from “off” to “on” when the system is enabled.

auto support and resistance indicators use electronic signal technology to help you determine how well the machine is operating.

How to Use Auto Support and Resistance Indicators?

Auto support and resistance indicators can be used to buy Elliott Wave ETFs. To use these indicators, start with a positive outlook and look for signs that the trend is beginning to change. For example, if you see signs that the market is starting to trend upward, you might buy an Elliott Wave ETF that tracks this trend.

Use Auto Support and Resistance Indicators to Sell Elliott Wave ETFs.

If you feel like the market is going too far down, you can sell your Elliott Wave ETFs using auto support and resistance indicators. To do this, look for signs that the market has begun to turn down or that resistance levels are becoming too high.

For example, if you see signs of a downtrend in the market, you might sell your Elliott Wave ETFs at a lower price than when it was bought.

Conclusion

Auto Support and Resistance Indicators can be used to buy and sell Elliott Wave ETFs. By starting with a positive outlook and using Auto Support and Resistance Indicators to buy Elliott Wave ETFs, you can increase your chances for success while reducing the risk associated with trading Elliott Wave ETFs.

Additionally, by selling Elliott Wave ETFs through Auto Support and Resistance Indicators, you can help to achieve desired results while reducing the cost associated with this type of trading.

![Mastering Advance Option Chain Tool [AOC]: A Trader’s Key to Success](https://seorub.com/wp-content/uploads/2023/07/A-trader-life-with-advance-option-chain-tool-AOC1-150x150.jpg)