Yes, Fibonacci and market profile can be used in combination for intraday trading to gain a better understanding of the market’s structure and potential support and resistance levels.

The Fibonacci tool can be used to identify potential retracement levels and support and resistance levels, while the market profile can provide insights into the market’s volume and price distribution. By combining these tools, traders can gain a more comprehensive understanding of the market and potentially identify high-probability trading opportunities.

Here are some steps to combine Fibonacci and market profile while intraday trading:

- Identify the high and low points: Use the Fibonacci tool to identify the high and low points of the stock’s price action during the trading session.

- Draw the Fibonacci retracement levels: Draw the Fibonacci retracement levels from the high point to the low point, as described in the previous answer.

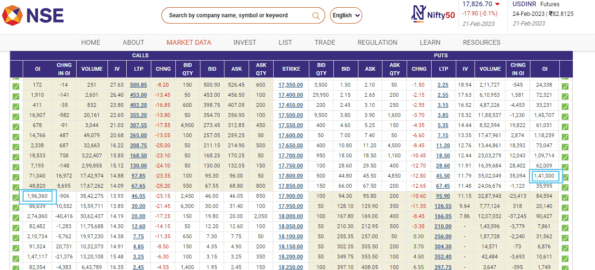

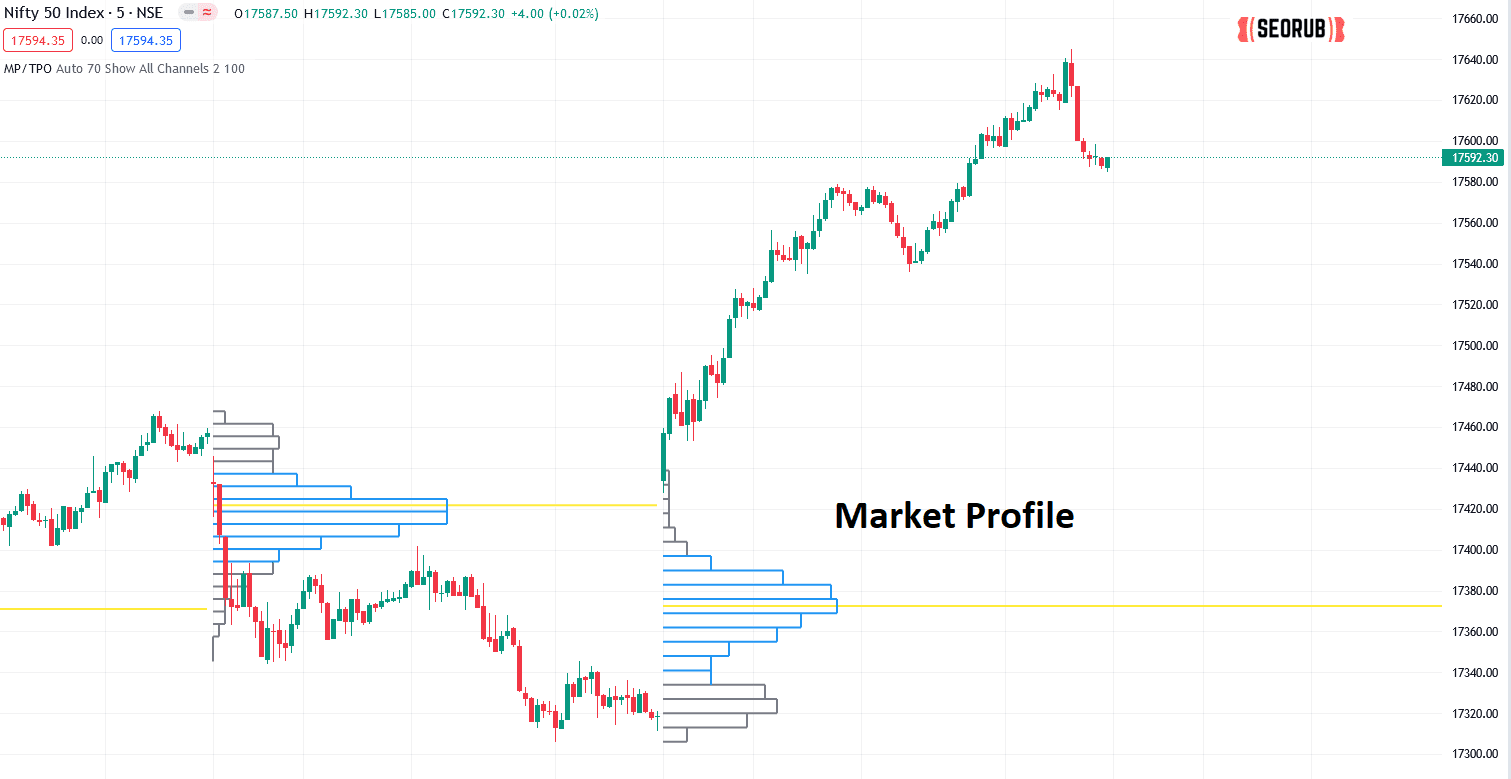

- Overlay the market profile: Overlay the market profile onto the chart to gain insights into the market’s volume and price distribution. The market profile can help identify potential support and resistance levels based on where the most volume is concentrated.

- Look for confluence: Look for areas where the Fibonacci retracement levels and the market profile levels intersect. These areas of confluence can provide higher-probability trading opportunities.

It’s important to remember that no single tool or method can provide a complete picture of the market, and it’s important to use a combination of tools and analysis methods to make informed trading decisions. Additionally, always do your own research and analysis before making any trading decisions, and consult with a financial professional if necessary.

Fibonacci levels are a popular trading strategy that can be used to predict the market’s future. It’s a simple strategy, but it can provide you with valuable insights. If you want to use Fibonacci levels in your trading career, there are some things you need to know. In this article, we’ll take a look at how to trade Fibonacci levels with the market profile.

What are Fibonacci levels?

A Fibonacci level is a sequence of numbers that indicate the progress of financial security. It is used to determine a trend and to place orders in a stock market.

Fibonacci levels are typically used to establish buy or sell signals, but can also be used as support or resistance levels.

What is the main difference between Fibonacci levels and other levels?

The main difference between Fibonacci levels and other levels is that Fibonacci levels are specifically designed to indicate the progress of financial security. This makes them especially useful for trading stocks, as they can provide buy or sell signals.

How to use Fibonacci levels to trade stocks.

To use Fibonacci levels to trade stocks, you first need to understand how they work. In general, these levels are used to determine a trend and place orders in a stock market. To do this, you will first need to understand what they are supposed to do.

Fibonacci levels are used to establish buy or sell signals. They can also be used as support and resistance levels. When used correctly, Fibonacci levels can provide valuable information for trading stocks.

How to Use Fibonacci Levels to Trade Stocks?

One of the best ways to use Fibonacci levels to trade stocks is by using a trading strategy. To develop a Trading Strategy, you first need to determine what type of stock you are interested in trading and how you want to trade it. Next, you must choose a Fibonacci level that corresponds with your target stock price. Finally, you must set your stops and take profits when you have a good idea about the direction of the stock.

Use Fibonacci levels to trade stocks in a portfolio.

If you are interested in trading stocks in a portfolio, then using Fibonacci levels can be an effective way to do so. By following a specific Fibonacci level-related trading strategy, you can achieve consistent results while mitigating risk. Additionally, by utilizing different Fibonacci levels in tandem with other investing strategies, you can create more complex or profitable portfolios that are harder for other investors to replicate.

Tips for Successful Trading with Fibonacci Levels.

One of the most important things you can do to be successful in trading stocks is to have a good trading strategy. This means using Fibonacci levels as a trading guide.

To get started, you’ll need a good idea of what your desired stock price range looks like. Next, you need to find the Fibonacci level that corresponds to this range. Finally, use this level as your starting point for trading. By following this strategy, you should be able to make some great profits while also taking little risk.

Use Fibonacci levels to trade stocks in a portfolio.

If you want to invest in stocks, you must take into account the fact that different stocks will respond differently to changes in prices. For example, if you want to buy a stock that is down by 10%, but up by 5%, then your best bet would be to buy two shares of the same company at the same time and sell them back at once – rather than trying to hold on to one share and hope it falls back down again).

For you to make money investing in stocks with Fibonacci levels, it’s helpful firstly To understand which stocks are sensitive (they will react differently depending on how much money they have) and secondly To find an appropriate time frame within which to hold each share so that when prices move up or down within that time-frame (ie: during extended periods of stability), you still make money) and finally, To set up your Trading position so that when prices move in a particular direction (ie: towards the Fibonacci level), you make money.

Conclusion

With a good trading strategy and a knowledge of Fibonacci levels, you can make great profits when trading stocks. Always keep a trading plan in place and use Fibonacci levels to trade stocks in a portfolio so that you are always making money. If you have any questions or want to learn more about this particular level, please visit our website or contact us. Thanks for reading!

![Mastering Advance Option Chain Tool [AOC]: A Trader’s Key to Success](https://seorub.com/wp-content/uploads/2023/07/A-trader-life-with-advance-option-chain-tool-AOC1-150x150.jpg)