Option chain trading is a strategy that involves analyzing the option chain of a particular security to gain insights into the sentiment of market participants and to identify potential trading opportunities.

The theory behind option chain trading is based on the idea that the options market can provide valuable information about the behavior of market participants and the supply and demand dynamics of a particular security.

As introduction: Option Chain Trading is the perfect way to make money in the stock market. The process is simple, and you can get started right away. You simply buy stocks and sell them at a higher price, then buy back the stocks at a lower price and sell again. This process repeats until you reach your target price. Option Chain Trading can be profitable even if the market doesn’t go your way.

Which Value we can trade via Options?

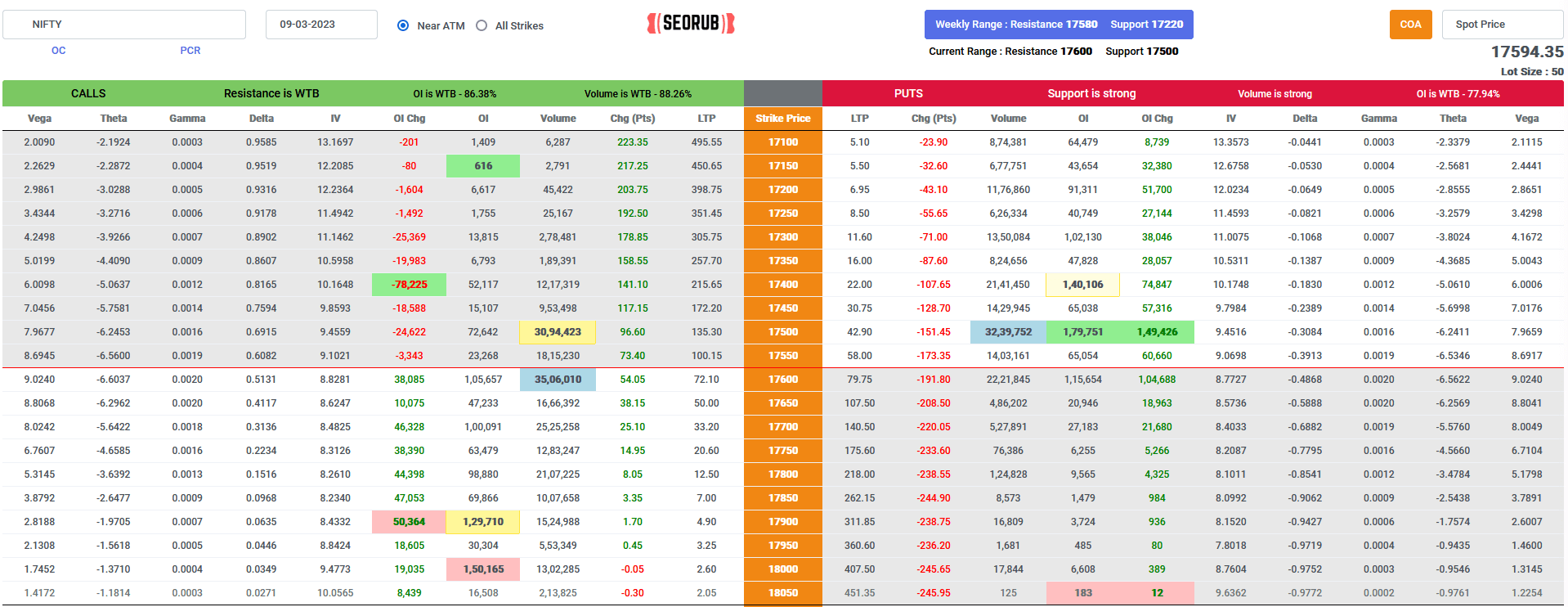

The option chain is a list of all the available options for a particular security, including the strike price, expiration date, and option type (call or put). By analyzing the option chain, traders can gain insights into the sentiment of market participants, such as whether they are bullish or bearish on the security, and can use this information to identify potential trading opportunities.

Any Examples:

If the option chain shows a high volume of call options with a strike price that is higher than the current market price of the security, this could be an indication that market participants are bullish on the security and expect its price to rise. Traders could use this information to identify potential buying opportunities in the security or to sell put options at a strike price that is lower than the current market price.

What are the type of Option trading strategies?

Option chain trading can be used in conjunction with other trading strategies, such as technical analysis and fundamental analysis, to gain a more comprehensive understanding of the market and to make more informed trading decisions.

However, it’s important to note that option chain trading carries a level of risk and traders should always do their own research and analysis before making any trading decisions. Additionally, traders should have a solid understanding of options trading and risk management techniques to minimize their exposure to risk.

What is an Option Chain?

An option is a right to buy or sell a security at a set price. A trader can purchase an option with money they already have, or they can borrow money and buy an option from someone else. The trader then has the right to purchase the security at the set price, but only if they meet all of the conditions specified in the option.

How Do You Get started in Option Trading?

Option trading can be very profitable for traders if they understand how options work and how to trade them correctly. To get started, you will first need to identify what type of options you are interested in buying and selling. There are three main types of options: calls, puts, and dividends (stock splits).

To purchase an option, you will need to identify which type of option it is- a call, put, or dividend stock split. Once you have determined which type of option you want to buy, you will need to find someone who has an option that matches your needs- either through a broker or through online exchanges like Amazon or Google Play. If you are trading options on your behalf, it is also helpful to read information about binary options so that you understand how these products work and why they could be valuable for your business.

What are the Different Types of Options?

Options come in two types: open-end and closed-end varieties. An open-end option is where the investor owns the underlying security while a closed-end option gives investors ownership of whatever security is outstanding at any given moment – this means that once an investor sells their position in an open-end product, they no longer own that particular security; instead, they own shares of another security that has continued underwater (the “underlying” stock).

Closed-adoptions usually have much more stability since they can’t be easily canceled (you can’t “sell” them), but this makes them more expensive due to their rarity (most closed-adoptions must be bought back by the company issuing them).

Open-ended options allow traders to speculate on future prices by buying and selling those same options at different points in time – this allows for greater flexibility when it comes to timing your trades! Open-ended products also offer some unique features not found in closed-end products such as being able to exercise (buy) or sell those same options immediately upon receipt of notice from the issuer(s) authorizing such action; however, these features may not be available on all closed-end products.”

How to Trade Options.

The first step in options trading is to choose the right option. This means finding an option that offers a high potential reward and low risk. To do this, you’ll need to know the strike price of the option and the company’s current share price. You can find this information online or in a company’s filing cabinet.

How to Trade the Option?

Once you have this information, it’s time to start trading! To trade an option, you’ll need to enter your purchase and delivery prices into a brokerage account, which will then pay you based on how many shares you buy and sell. In order to make sure your option trade is profitable, it’s important to use good market analysis tools like The Street Quant Ratings or Stock Twits.

How to Close an Option?

When you finish trading your options, you should close out any outstanding positions by entering into a settlement agreement with your broker-dealer. This will result in receiving money from your account in exchange for selling your options).

![Mastering Advance Option Chain Tool [AOC]: A Trader’s Key to Success](https://seorub.com/wp-content/uploads/2023/07/A-trader-life-with-advance-option-chain-tool-AOC1-150x150.jpg)